The Government of India launched the Bharat 22 ETF on 14th November 2017.

Bharat 22 is an Exchange-traded fund (ETF) which will closely track the performance of the Bharat 22 Index.

This post explains the Bharat 22 ETF in detail.

What is Exchange-Traded Fund/ ETF?

ETF is a security that tracks the performance of an index, a commodity or a basket of assets.

Let’s say, there is an ETF which wants to track the performance of SENSEX. To do it, it will invest in the 30 stocks comprising the SENSEX, in the same weights as these stocks are represented in the index.

This will help the ETF to generate returns that are commensurate with the performance of SENSEX.

(Read: What is SENSEX and how is it calculated?)

So, if you buy a SENSEX ETF, you are essentially diversifying your investment. It is less risky than buying the share of an individual company.

The ETF can be traded in the stock market just like shares.

What is Bharat 22 ETF?

- Bharat 22 ETF is an ETF that will track the performance of the Bharat 22 Index.

- The BSE had launched the Bharat 22 Index on 10 August 2017, in consultation with the Government. This index will be rebalanced annually.

- Bharat 22 consists of shares of 22 large companies from the universe of Central Public Sector Enterprises (CPSEs), Public Sector Banks (PSBs) and some of the strategic holding of the investment arm of the Government called SUUTI ( or Specific Undertaking of Unit Trust of India.)

- [The Government will basically sell its stakes in these PSUs to a Mutual Fund company which manages an ETF. The Mutual Fund company will sell ETFs units based on basket of these 22 companies to public investors]

- ICICI Prudential Mutual Fund AMC will manage the fund.

- Lastly, the Bharat 22 is an open-ended fund. It means that it does not have a fixed maturity and can be easily bought and sold in the stock market.

[You may also read: What is Mutual Fund? How does it work?]

What is the purpose of launching Bharat 22 ETF?

It is a vehicle chosen by the Government to disinvest its stake in 22 companies, of which 19 are state-owned and 3 are private in which the Government has some stake (invested through its investment arm SUUTI).

The Government disinvestment target for the financial year 2017-18 is Rs.72500 crores. Out of this, only Rs.9300 crore had been raised before the launch of the Bharat 22.

The Government intended to divest shares worth Rs.8000 crores through the this ETF. But, the issue was oversubscribed by 4 times due to strong sentiments in the market. Therefore, the issue was raised to Rs.14500 crores.

Bharat 22 is the second ETF launched by the Government.

The first ETF was launched in May 2014 and was known as CPSE ETF. The Government had divested Rs.11500 crores in all through this ETF.

What is the difference between CPSE ETF and Bharat 22?

CPSE ETF had only 10 companies. It was less diversified as most of the companies were from the energy sector. Also, all of the companies were CPSEs.

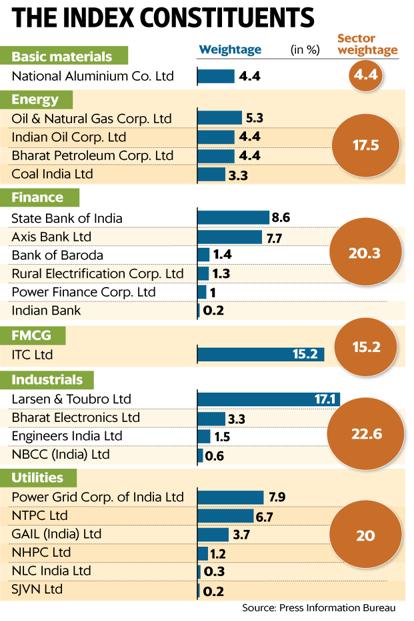

Bharat 22 is more diversified with investment in 22 companies across 6 sectors namely Basic materials, Energy, Finance, FMCG (Fast-Moving Consumer Goods), Industrials and Utilities

There is a 20 % cap on each sector and 15 % cap on each stock.

What are the benefits of investing in Bharat 22?

- It provides diversified exposure.

- It is a good long-term investment opportunity. The index has outperformed the BSE SENSEX over a 10-year horizon and offered higher dividend yield historically.

That’s all for this post

Liked it? Don’t forget to share.

Here are some hand-picked articles that you should read:

What is Universal Basic Income and is India ready for it?

The ultimate guide to understanding the Insolvency and Bankruptcy Code 2016

Here’s all you need to know about Aadhar card

References:

GOOD AFTERNOON SIR,

THIS SITE IS VERY USEFUL TO COMMERCE STUDENTS AS WELL AS THOSE WHO WANT TO KNOW ABOUT THE INDIAN ECONOMY HAPPENING.

SIR THROUGH THIS EMAIL I WANT YOUR CONCENTRATION ON ONE THING THAT IF YOU WILL DEVELOPE ITS APP AND PROVIDE SERVICE THROUGH IT, THEN IT WILL BE MORE USEFUL. AS THERE IS SOME PROBLEMS RELATED TO SITE ACCESS SOME OF THE TIME.

THANK YOU.

Hello Aman,

I had tried to create an app, but I am unable to fix some technical issues with it. You can subscribe to my blog by email. Also, there should not be any site access issues now. If you still face problems, do let me know. Thanks

Mridusmita

Great informative post brother.. Thanks for sharing.