The Organization of the Petroleum Exporting Countries(OPEC) has designed a deal to cut its oil production by 1.2 million barrels per day. This has been done to increase the oil prices globally.

It has planned to re-balance the oil market by cutting back its production to 32.5 million barrels per day from 1 January 2017. Presently, the total oil production of OPEC’s member countries is about 33.7 million barrels of oil per day.

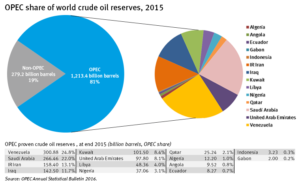

OPEC is a cartel/ group of 13 major oil producing countries headquartered in Vienna, Austria. Its main objective is to formulate petroleum policies among member countries in order to seek stability in the market and to ensure a fair return to those investing in the industry. It accounts for the production of about a third of the world’s oil.

Recently, it has also been reported that eleven non-OPEC oil producing countries led by Russia have also agreed to cut their oil production with the purpose of decreasing the oversupply of oil in the market.

The rationale behind the cut in oil production

A detailed study of the changing global scenario over the past two years indicates many factors behind the proposed cut in the oil output. Some of them are:

- The world oil prices had been doing well from 2010 until mid-2014. An important global benchmark price for purchasing oil- Brent crude was selling at around $110 a barrel. But since June 2015, the prices started falling and it plunged below $50 a barrel. (You can read the reason for the decrease in oil prices in this article: Fall in Global Oil Prices: Demystified). The plummeting price of oil with the growing oversaturation in the market worried the oil producers about the significant revenue shortfalls. Hence, a cut was necessary.

- Ample production by the United States of America has troubled the oil cartel OPEC’s most important member, Saudi Arabia. Once in the hope of hurting US shale and oil gas industry with its higher production costs, Saudi Arabia refused to cut down the production in 2014 (when the prices actually started falling down). It was done with the purpose of blowing the US out of this business and reap the benefit without losing the market share. But, it had little effect on the US. Meanwhile, the return of Iran to the oil market (after EU and US sanctions were lifted as part of the nuclear deal) hurt Saudi economy badly in terms of declining oil revenue day by day. Hence, it is in the higher economic interest of OPEC member countries including Venezuela and Nigeria experiencing the turmoil to shore up the oil prices in order to increase the government expenditure and swell their foreign exchange reserves to meet up other costs.

- Another reason for the cutback was the bearish demand of oil in the market due to weak economic growth in Asia and in developing nations around the world. Renewable energy sources don’t make up a big enough share to cut into demand for oil. But, gains in efficiency, and the rise of the electric car, analyst Steven Kopits says, could be game changers.

- This time OPEC’s credibility was also under question. As the key player of OPEC, Saudi Arabia possessing the large production capacity and indirectly influencing the global oil deposits was under criticism for its weak decision making and inability to form consensus among the global oil producers regarding the production cut.

How exactly does the Indian economy gets affected by the crude oil prices?

Our country’s economic growth is highly dependent on the import of crude oil. As when the price rises, it results in spending huge amounts of foreign exchange.

- India with its increasing oil demand has become the world’s third-largest oil consumer. At present, India imports around 75% of its total oil requirement from major oil producing countries (like Saudi Arabia, Kuwait & Iran) and around 25% of the country’s total oil demand is being met by oil reserves found in Mumbai High Basin off the coast of Maharashtra, Gujarat, Rajasthan and in eastern Assam.

- Crude oil act as a major raw material to various industries and too much price rise results in high cost of production. Hence, shooting up oil prices will adversely affect the country’s growth story.

- It is highly used in the transportation of goods and services. So, if there is an increase in oil prices then it will also increase the prices of goods and services. And consequently, inflation will also rise.

- Too much rise in oil prices is not good for Indian Rupee as well. This can also increase India’s current account deficit (net revenue on exports minus payments for imports. Total exports is a country’s income – It is what the country is selling to the world. Total imports is a country’s expenditure). Also, the value of a floating currency depends on its demand in the foreign exchange market. And this could increase the demand for dollar vis-a-vis Indian rupees. Hence, it would depreciate the value of the rupee as India will pay its bills in dollars (many oil producing countries would accept only dollars for their black gold, the oil).

Overall, it is crystal clear that the rise in global oil prices is not at all beneficial for India. So, in this case, India has to find other alternatives to drive its development projects instead of being totally dependent on fluctuating oil prices.

Conclusion

Looking at the greater consensus between the major oil producing nations on the plank of decreasing oil production it can be expected that the oil prices will rise worldwide. But at the same time, US will also play a major role in determining the success of this deal.

Over the past two years, the stunning fall in oil prices has hit the project investment in places like the United States, Canada and Brazil. But, they can again start the drilling as the OPEC successfully slow down its production and inflate the oil prices. As a result, this increase in output can fill in supply gaps left by OPEC.

References :