Inflation measured by the Wholesale Price Index (WPI) rose to 14.2 % in November. It is the highest since April 2012, the earliest period for which WPI data is available under the 2011-12 series.

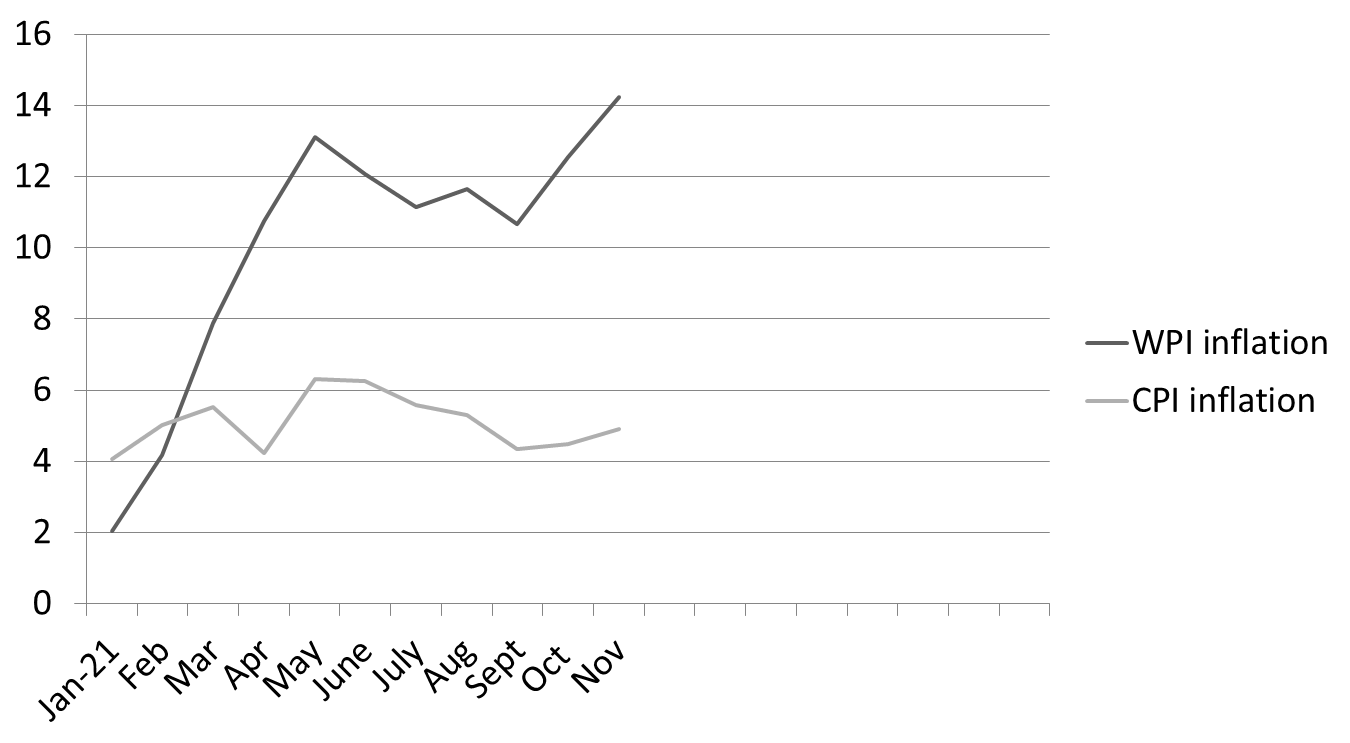

WPI inflation is at the double-digit level for the last 8 months

Inflation measured by Consumer Price Index (CPI) is 4.9 %.

Generally, WPI inflation is lower than CPI inflation, but it has been continuously increasing and the difference between the two inflation figures has widened to 9.32 percentage points. (See chart below)

This article seeks to explain the factors responsible for this divergence.

Before moving ahead, I’d recommend you to read this article to understand WPI and CPI- Inflation demystified

Reasons for divergence between WPI and CPI inflation:

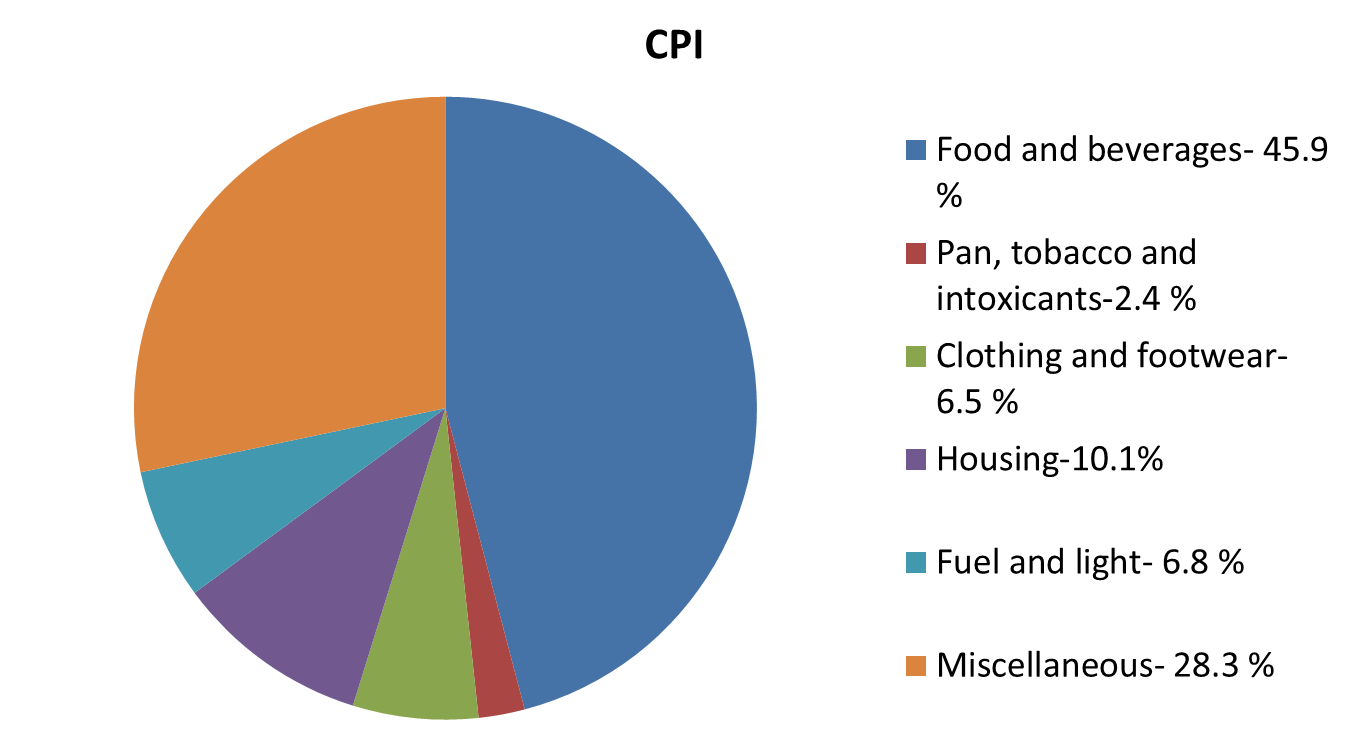

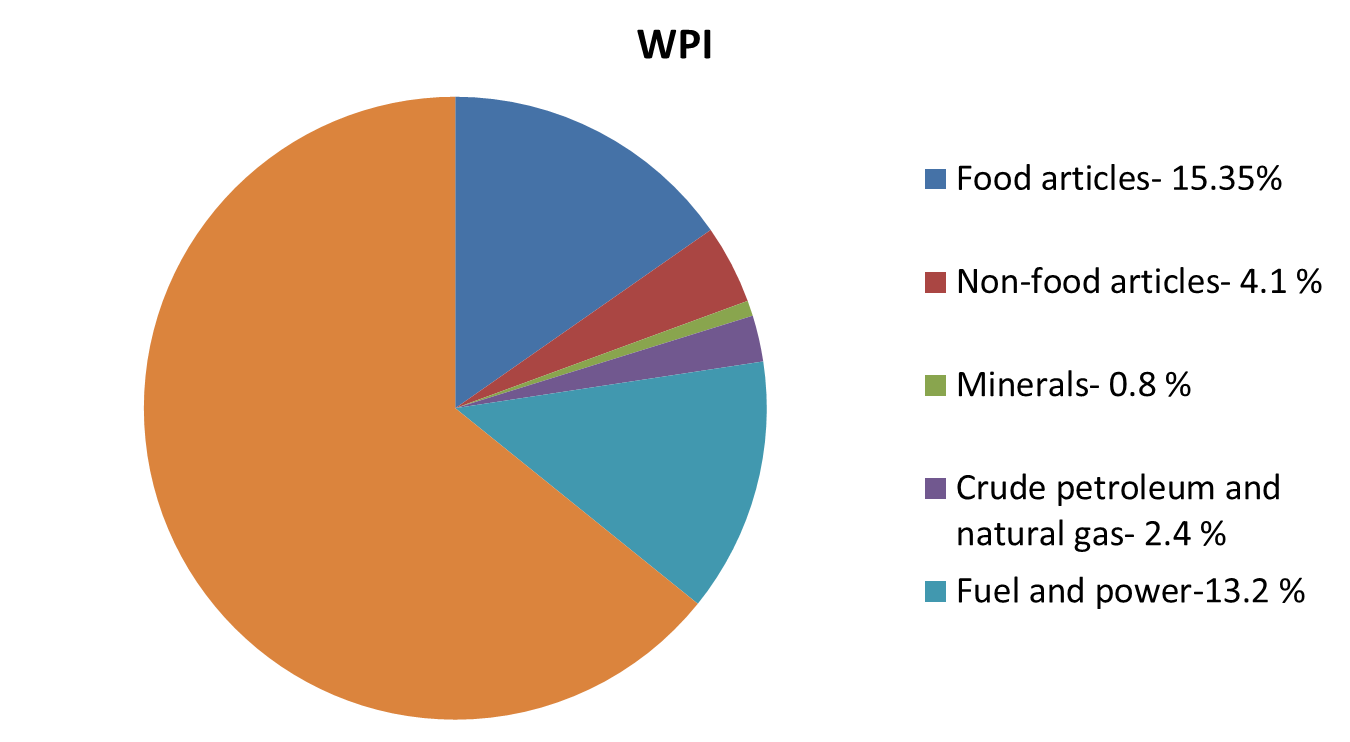

• Difference in the composition of the basket to calculate WPI and CPI: Wholesale Price Index (WPI) measures the price level of goods traded in the wholesale market. It includes basic and intermediate goods also. Consumer Price Index (CPI) includes those goods and services in the retail market which are representative of expenditure by a typical consumer. It includes services which is not included in WPI. The difference in constituents and weightage of both baskets are representated below:

• The increase in WPI inflation has been led by surge in prices of food and fuel & power. WPI inflation in food index jumped from 3.06 % in October 2021 to 6.70 % in November 2021. In contrast, CPI inflation in food in November 2021 was 1.87 %. Though, the weightage of food in CPI is higher, it has not affected CPI inflation, as retail food prices have increased at a slower pace in 2021. This is because of higher base effect. Food prices were already high in the beginning of 2021. Between April and November 2020, CPI inflation was as high as 9.9 %, and between April and November 2021, it was only 2.8 % due to higher base effect.

• WPI inflation in fuel and power has been increasing since July 2021. Fuel and power has higher weightage in WPI.

• Fuel and power is an input in manufacturing and transportation. Therefore, this inflation spills on to inflation in other categories.

• Inflation in manufactured goods is also high. In the last 3 months, inflation in this category has been around 12 %. Manufactured goods have the highest weightage in WPI (64.23 %). Within manufactured goods, inflation in seven groups namely, textiles, paper & chemicals, rubber & plastics, basic metals, fabricated metals and furniture has been in double-digits now for six successive months, with textiles, paper and chemicals touching a new record high in November 2021

• Another reason for this divergence is, WPI inflation is reflected in CPI inflation with a time lag and currently, it is not transmitted due to weak demand. Even though input cost of producers has increased, they are wary of passing on the higher costs to the consumers.

To conclude, it is expected that the WPI inflation will remain in the double digits for the next few months due to rising international crude oil prices and depreciation of rupee (depreciation of rupee makes imports costlier). The prices will also remain high due to the new coronavirus variant, Omicron, which could disrupt the supply chain.

Economyria is now on Telegram. For a simplified analysis of topics related to economy/ business/ finance, subscribe to Economyria on Telegram

Thanks for the insights.

Why there is a Disconnect between real economy and India’s equity markets ?

From the GDP perspective,

Real GDP = Nominal GDP – Inflation Rate

As per First Advance Estimate For FY 2021-22, Real GDP is expected to be 9.2%, whereas Nominal GDP is expected to be 17.6%. So Inflation comes out to 8.4%.

Does this reflects WPI or CPI ?

However, as per your above article, WPI is 14.2% whereas CPI is 4.9%.

Can you please explain this difference

Hi, advance estimates take an estimate of the annual inflation. This article is about the figures for November