Wifi…Hifi…Sci-fi…DeFi…erm what?

You may or may not have come across the term Defi, depending on the size of the rock you have been living under.

What is DeFi?

Elementary, my dear Economyria readers.

DeFi is the opposite of CeFi.

Confused?

We’ll try to explain DeFi to you at the most basic level.

DeFi Explained

Before we delve into DeFi, let’s spend a few moments talking about CeFi.

We are all familiar with CeFi or TradFi i.e. Centralised Finance or Traditional Finance.

Traditional Finance refers to the financial system in which central bodies like banks and other financial institutions like NBFCs provide the financial services and run the system. These banks and institutions are regulated and governed by central banks and government bodies. SBI, RBI, Bajaj Finance, Goldman Sachs etc are all part of traditional or centralised finance.

DeFi stands for Decentralised Finance.

Leveraging blockchain technologies, DeFi is a financial system in which there is no central authority, regulatory or otherwise.

What this basically means is you don’t need to deal with a bank or financial institution for your financial needs like availing a loan.

Lest you are bored already, let me throw in a fun fact to entice you to read further about DeFi.

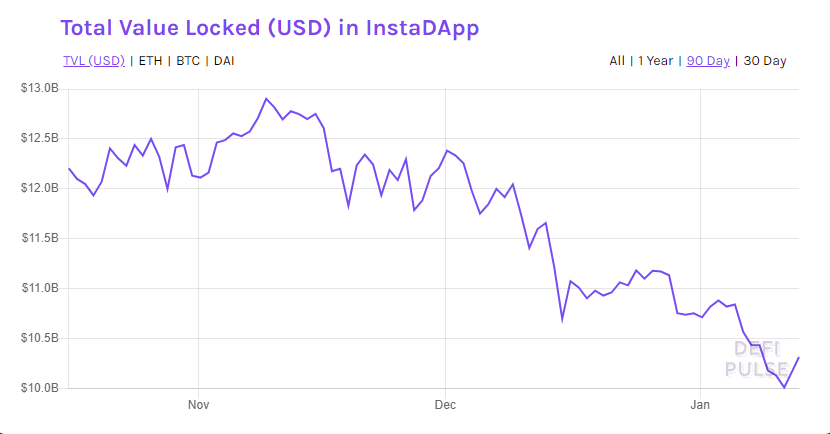

Currently, there is over 90 Billion US Dollars worth of money locked across Decentralised FInance platforms. (Refer TVL – Total Value Locked)

There’s a lot you can do via DeFi apps (decentralised finance applications). Some of the common uses being lending, borrowing, earning interest on deposits etc – all without the involvement of any intermediary or central authority. No wonder banks and other leading financial institutions are irked!

DeFi apps form the financial ecosystem of Web3. Web3 is user-owned and hence DeFi is characteristic of high ownership by users. This is starkly different to the traditional financial world being ruled by a few legacy institutions.

There are platforms like Maker, Aave, Compound Finance where one can instantly borrow money against their crypto holdings. You can also lend cryptocurrencies on these platforms and earn interest. In certain cases, the APY(Annual Percentage Yield) that can be earned on deposits goes up to 500% or more.

InstaDApp, started by 2 Indian brothers in their 20s, is one of the top DeFi platforms in the world with over 10 Billion USD worth of value locked on the platform.

There are DEXes(short for Decentralised Exchanges) like Curve Finance, Uniswap, Sushiswap where you can trade or exchange cryptocurrencies. A DEX is a peer-to-peer marketplace. (Can you now guess what is a CEX?)

Most DeFi platforms use the Ethereum blockchain. Hence, with billions of dollars riding on the Ethereum blockhain, it becomes easier to comprehend why a lot of crypto investors prefer to invest in Ethereum.

In summary, DeFi provides financial services for Web3.

Web3 is attractive not only due to concepts like decentralised ownership but also due to the fact that there are financial incentives embedded across all components of Web3 for users/owners. Lot of exciting things that can be done via DeFi, but more on that later.

If you wish to catch up on some commonly used crypto terms, please click here.

Or if you wish to read about the most fun cryptocurrency and the first meme token, click here.

Image(DeFi Explained) Credit: Gold photo created by master1305 – www.freepik.com