Southern states are protesting because they believe it is unfair that they contribute significantly to Central Government taxes but receive disproportionately little in return.

Firstly, let’s delve into the tax structure in the country:

The State Governments gathers taxes on alcohol, fuel, road tax, stamp duty, and a share of the GST

Meanwhile, the Central Government collects various taxes including Income tax, corporate tax, and a share of the GST. Regardless of whether one resides in Karnataka or Uttar Pradesh, taxes on income are directed to the Central Government, including those from IT companies in Karnataka.

A portion of this revenue remains with the Central Government, while the rest is distributed among states.

Two primary questions arise:

- How much percentage of the total revenue should the Central Government distribute? This is known as vertical devolution of funds.

- How should the revenue be distributed among states? Equally or based on certain factors? This is referred to as horizontal devolution.

Both of these questions are addressed by the Finance Commission, currently overseen by Arvind Panagriya.

As per the 15th Finance Commission, the share of states in the central’s tax revenues was recommended to be 41%. Hence, the central Government distributes 41 % of revenues it receives to the states. [vertical devolution]

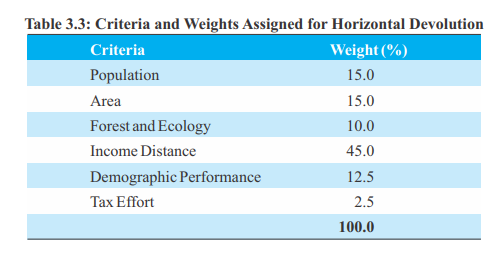

For Horizontal Devolution, the previous Finance commissions have assigned various factors [see table below]

As the above table suggests, Income distance is one of the major criteria for distribution of funds. [Income distance is the difference between per capita income of the richest state and the state’s per capita income]

Typically, poorer states receive a larger share of taxes.

What’s the issue?

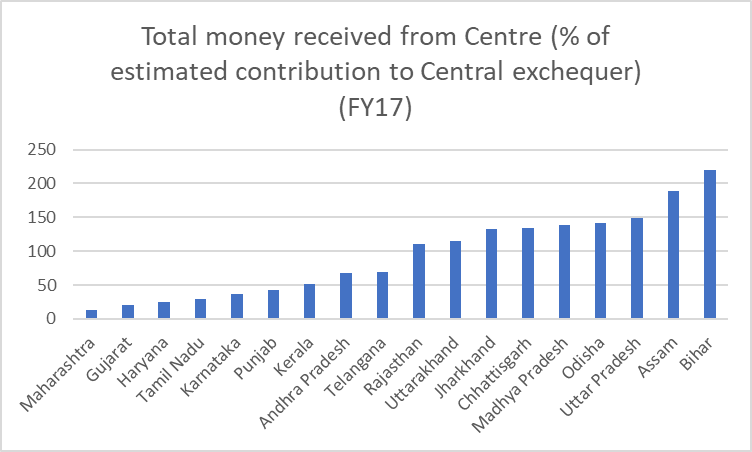

Karnataka feels that for every Rupee it contributes to the Central Government as taxes, it receives only 12 to 13 paise in return. [Refer to the chart below]

This disparity is significant, especially when compared to states like Bihar, which receive more than Rs. 200. Such states feel that it’s unfair.

It’s crucial to note that this isn’t solely a north-south debate; it’s a matter of disparity between the rich and the poor. States like Maharashtra, Gujarat, and Haryana are also affected.

Examining the situation from a per-capita perspective yields a different outlook. In per capita terms, both Bihar and Uttar Pradesh received fewer transfers from the Centre in 2016-17 compared to states like Andhra Pradesh, Karnataka, and Kerala.

In conclusion, the ongoing protests in Southern states highlight the need for a fair and equitable distribution of Central Government taxes. However, a more holistic approach is necessary to assess the fiscal transfers from the Central Government, considering the benefits that Karnataka derives from cheaper labor from other states, as well as from being part of the Indian Union. Moreover, in per-capita terms, Karnataka is receiving a higher share, which adds complexity to the issue.