The Rajya Sabha, on Thursday, passed the Factoring (Regulation) Amendment Bill, 2020 [amending the Factoring (Regulation) Act, 2011] to increase the participation of Non-Banking Financial Companies (NBFCs) in the factoring sector. Amid the Pegasus scandal, the reform went largely unnoticed. Nevertheless, it has significant implications for the micro, small and medium enterprises (MSME) sector, as we discuss in this article.

[You may read- THE PEGASUS SCANDAL- WHAT IS IT AND HOW DOES THE SPYWARE WORK?].

What is Factoring?

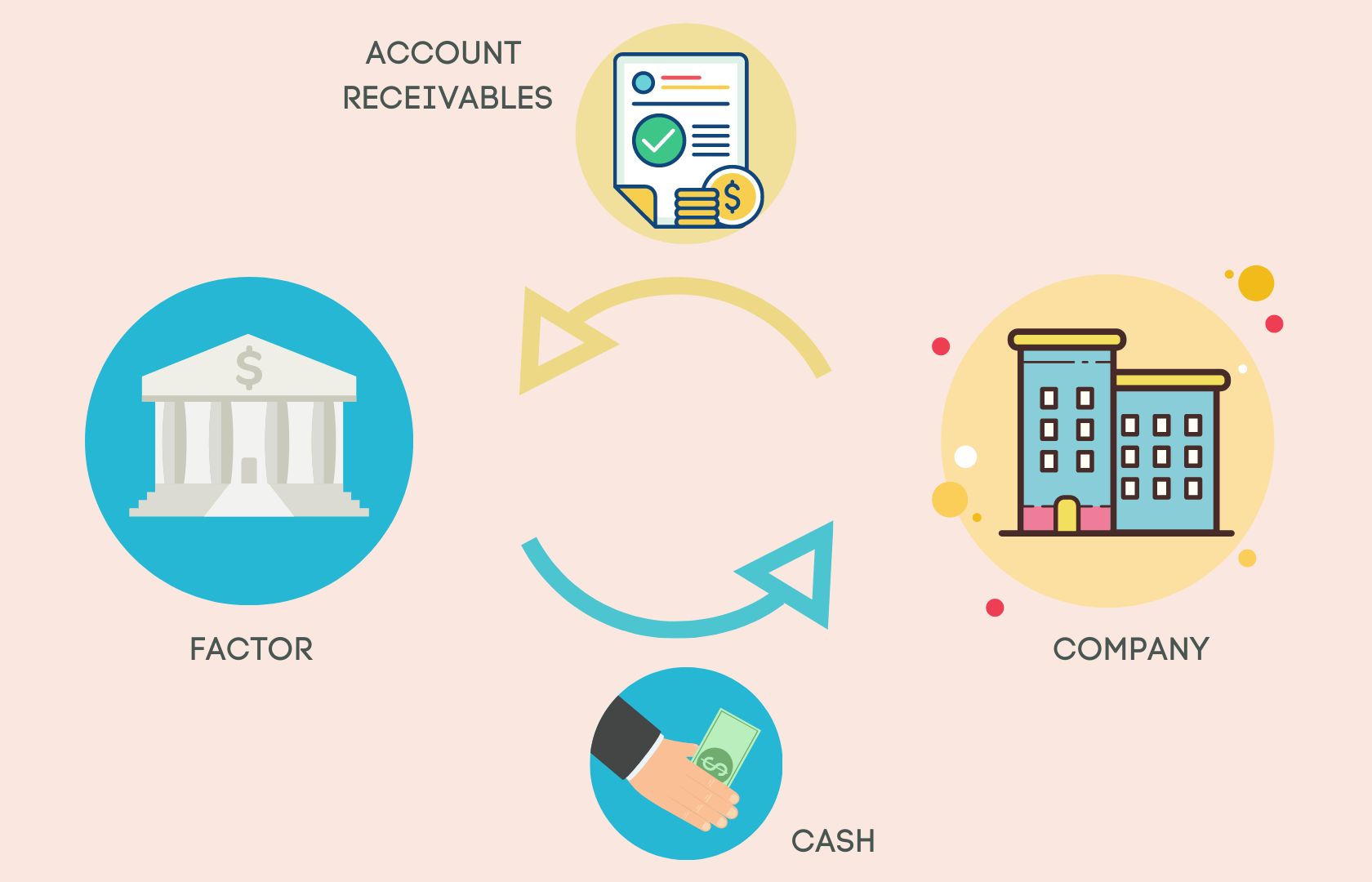

Factoring refers to a transaction in which an entity/business sells a whole or part of its receivables to a third party (known as the ‘factor’) for immediate funds.

Receivables refer to the amount yet to be paid by a customer for using the goods, services, or facilities offered by the entity/business. For instance, if an entity ‘A’ sells edible oil worth Rs. 100 to a customer ‘B’ on credit, ‘A’ will record the transaction as ‘account receivables’ in its balance sheet. It is an asset for the entity as it will receive the amount in the future.

Upon selling these receivables to a factor, the entity can obtain immediate funds and ensure a regular cash flow to run its operations. The factor can recover the amount from the customer subsequently. Also, the factor, while paying the entity, discounts a certain amount for itself.

In this process, the entity does not have to give any collateral to the factor, nor is it responsible for non-payment of the amount by the customer to the factor. Thus, it stands to benefit them immensely.

Background to the Bill

MSMEs often face a delay in getting payments from various buyers for supplying goods and services. This affects their cash flow for running day-to-day operations and hampers their productivity. As a result of this and many other problems faced by the MSMEs, the UK Sinha Committee was appointed by the Government in January 2019.

Based on its recommendations, the Factoring Regulation (Amendment) Bill 2020 was introduced in September 2020. Subsequently, it was referred to a Parliamentary Standing Committee on 24th September 2020. The recommendations of the Committee were entirely accepted, and the Bill in its present form was passed in the Rajya Sabha three days ago. [The Lok Sabha passed it on Monday].

What does the 2011 Act contain?

The 2011 Act provides a framework for the factoring sector in India by specifying the mechanism of Registration of Factors, Assignment of Receivables, Rights and Obligations of the Parties, Registration of Assignments, etc. [Assignment of receivables is nothing but selling receivables to factors for consideration]. The factoring business for the MSMEs is carried out through an online portal known as the Trade Receivables Discounting System (TReDS), on which invoices are discounted, and funds are released to the entity. There are currently three registered TReDS platforms in India. [Note that non-MSMEs can also participate in the factoring business but not on the TReDS platform].

How does the TReDS work? There are broadly three groups of people– sellers, buyers, and financiers (i.e., factors). Only MSMEs can participate as the sellers, i.e., the ones who sell their account receivables. Corporates, Government PSUs, and any other entity can participate as buyers, i.e., the ones from whom money is owed to the seller. Then there are the factors, including banks, NBFCs registered as factors, and other financial institutions as may be permitted by the RBI. [Under the 2011 Act, banks and corporations (created by statutes) need not register as a factor while NBFCs and other companies do].

First, a Factoring Unit (FU) is created, which contains details of invoices/bills of exchanges (evidencing the sale of goods/services by the MSMEs to the buyers). The FU has to be accepted by the buyers. Then, the factors bid for the FU; the seller selects the best bid, and accordingly, payment is made by the factor to the MSME (after discounting, i.e., deducting a certain amount). Finally, the buyer pays the factor instead of the seller on the due date.

[As reported by The Financial Express, “the industry has responded well to the TReDS scheme. Since April 2018, PSUs, large corporates, as well as banks such as SBI and Bank of Baroda, have recognised the platform’s criticality and have registered”].

Before the amendments, the Act was restrictive in its scope. The primary issue with the Act lay in Section 3 of the Act, which limited the number of Non-Banking Financial Companies (NBFCs) to participate as a factor. It provided that an NBFC can register as a factor (with the RBI) only if it was engaged in the factoring business as its principal business. [As per the Act, principal business means if the NBFC’s financial assets in the factoring business are more than 75% of its total assets or if its income from the factoring business is more than 75% of its total income]. This restricted the number of NBFCs in the sector to just seven.

As a result, the factoring market in India currently accounts for only 0.2% of the GDP compared to countries like Brazil (4.1%) and China (3.2%). The factoring credit contributes only 2.6% of the total MSME credit in the country compared to 11.2% in China. There is massive scope for growth in these numbers, and the amendments aim to address this issue.

What does the Amendment Bill do?

The present Bill seeks to ‘expand credit facilities for small businesses’ and help them in accessing funds quickly. The requirement for NBFCs to carry out the factoring business as its primary business to be registered as a factor has now been done away with. This will allow about 9,500 NBFCs to participate in the sector, a massive jump from just seven at present, thus expanding the scope of finance for MSMEs and other entities. In fact, the requirement of separate registration for NBFCs (as factors) has also been done away with, based on the recommendations of the Standing Committee Report. Just like banks, which are already exempted from registration as noted above, NBFCs can participate in the sector freely.

There are other significant changes as well. As per Section 19 of the 2011 Act, every factor has to register the particulars of every transaction of assignment of receivables in its favour with a central registry. To improve operational efficiency, where the transactions take place on a TReDS platform, the platform itself can register the particulars of each transaction with the central registry as an agent of the factors; the factors need not do so individually. Also, the time limit of 30 days to register the details of such transactions has been done away with; the RBI can specify the time limit in its regulations.

To make the TReDS platforms seamless and attractive, the Government will merge them with the GST e-invoicing portal. This will lead to the automatic uploading of all invoices on the platform and add an extra layer of authenticity to the process. All the parties on the platform will have real-time access to invoices as a result.

Further, the definitions of terms like “assignment,” “factoring business,” and “receivables” have been amended to bring them at par with the international definitions. Also, the Reserve Bank of India has been empowered to make rules and regulations with respect to the factoring business since a huge number of NBFCs will now be involved.

Thus, the seemingly unimportant Bill has massive consequences for the MSME sector and can prove to be a game-changer for the underdeveloped factoring sector. The Standing Committee Report had other important recommendations which the Government may consider. For instance, there must be a credit-rating mechanism for receivables. The existing agencies can provide ratings to MSMEs seeking to sell their receivables, based on which the factors can take an informed decision. The growth of the factoring sector in the coming years is instrumental for the success of the Bill.

Economyria is now on Telegram. For a simplified analysis of topics related to economy/ business/ finance, subscribe to Economyria on Telegram

But what happens when the receivables remains unrealised and turns bad ?

Besides, how is Factoring different from Forfaiting ?