The Government announced the National Monetisation pipeline (NMP) in August 2021 to raise Rs. 6 lakh crore over the next 4 years (that is, by 2025).

This amount raised would be utilized to fund infrastructure spending in the country. (new infrastructure spending is known as greenfield investment/project. These projects start from scratch).

Hence, it will complement the National Infrastructure Pipeline (NIP) of Rs 100 lakh crore announced earlier in December 2019.

National Monetisation pipeline/ NMP has been developed by the NITI Aayog in consultation with various ministries

First things first, what is asset monetization?

It is converting an asset into money without selling it outright.

How will the Government go about monetizing its assets?

It will transfer the rights of revenue from existing assets (known as brownfield assets) like roadways, airports, railways, etc to private parties for a specified period in return for money. To explain in simple terms, the Government could transfer toll tax rights for roads to a private party for 5 years in return for some upfront payment.

For instance- in 2020, the Maharashtra State Road Development Corp. Ltd awarded the tolling rights of the Mumbai-Pune Expressway and old Mumbai-Pune corridor for ₹8,262 crores. The private party would be responsible for the maintenance of the roads during the period.

In these contracts, the ownership of the asset will remain with the Government and it will regain possession at the end of the specified period.

The Government has decided to monetize only unutilized or underutilized brownfield assets (existing assets/ projects which has already been completed) which have stable returns.

Basically, the National Monetisation pipeline will enable Government to extract maximum value out of its brownfield projects (existing projects where investment has already been made) and use the funds for greenfield investments across the country.

It will ease fiscal constraints for the Government.

It will encourage private investment as the project has already been developed and will provide stable returns. There would be no risk of getting clearances etc to execute the project.

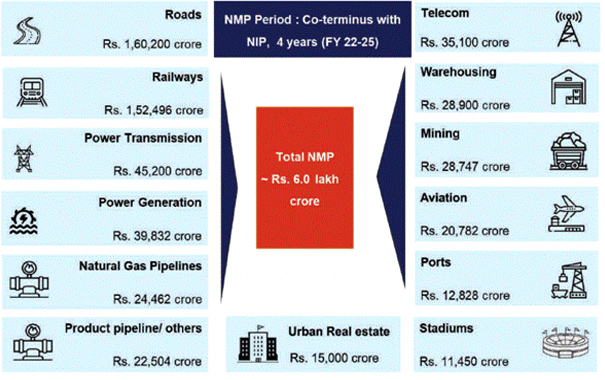

The top five sectors by value under the government’s asset monetization program are roads (27%), railways (25%), power (15%), oil and gas pipelines (8%), and telecom (6%).

Among projects the government plans to lease are 26,700km of roads, 90 passenger trains, 400 railway stations, 28,608 circuit km transmission lines, 286,000km of Bharatnet fibre network and 14,917 towers owned by state-run Bharat Sanchar Nigam Ltd and Mahanagar Telecom Nigam Ltd.

Source: //www.livemint.com

The Centre has selected 25 airports and 160 coal-mining projects for monetization over the next 4 years.

Apart from the above, the Government will monetize dedicated freight corridor assets, warehousing assets of state-run companies such as Central Warehousing Corp. and NAFED, and sports stadiums. See image below-

Is asset monetization a new idea?

Asset monetization is not a new idea in India, but the scale on which it will be done is unprecedented. Also, NMP will provide a clear framework and roadmap for monetization over the next 4 years

The idea of asset monetization was first suggested by a committee led by economist Vijay Kelkar in 2012 on the roadmap for fiscal consolidation. It was announced by Sitharaman in her budget speech 2021-22.

It has been successfully implemented in Australias as well.

There are various structures used to monetize assets:

- Public-private partnership (PPP) models such as operate-maintain-transfer (OMT), toll-operate-transfer (TOT), Operations, Maintenance & Development (OMD) etc. [PPP model means developing a project jointly by the Government or public sector enterprise and a private party. Delhi airport has been built under PPP model. The contract to maintain and develop the airport was signed between DIAL (private party) and Airports Authority of India (public sector entity) in 2006. DIAL will maintain the airport for 30 years (known as cooncession period) after which it will be transferred to the Airports Authority of India (AAI). The project that started in 2006 has been completed at a total cost of ₹12,500 crore]

- Structured financing vehicles such as infrastructure investment trusts (InvITs) and real estate investment trusts (Reits).

NMP has various challenges as well.

There have been delays in privatizing Government-run companies like Air India etc. Execution of asset monetisation is also a daunting task.

[You may also read: Govt. approves strategic disinvestment in 5 PSUs- Explained & Air India Privatisation : Why it should be done? – explained]

The Government will have to decide how to structure each transaction (which PPP model to use etc.).

Also, there is a lack of identifiable revenue streams in various assets. It complicates revenue sharing with the private party

Lastly, the revenue rights will be with the private sector for a limited time period. It could raise prices or spend less money on maintenance to maximize profits. For instance– Singapore had to nationalize its suburban trains and signaling systems because their main private operator had underinvested in maintenance, leading to breakdowns and stranded passengers.

Economyria is now on Telegram. For a simplified analysis of topics related to economy/ business/ finance, subscribe to Economyria on Telegram

Referring to the above analysis, how will the Structured Financing Model be different from PPP Model ?

What is HAM model? Has it been successful in India?

HAM/ Hybrid Annuity model is a combination of EPC (engineering, procurement, and construction) and BOT (build, operate, transfer) models

Under EPC, Government pays private players to build roads. Government arranges the finances for the project. The ownership of the asset is with the Government and it takes care of toll collection and maintenance.

Under the BOT model, private players have an active role — they build, operate, and maintain the road for a specified number of years — say 10-15 years — before transferring the asset back to the government. The private player arranges all the finances for the project while collecting toll revenue (BOT-TOLL model) or annuity fee (BOT-Annuity model) from the Government, as agreed.

HAM combines EPC (40 percent) and BOT-Annuity (60 percent). The Government releases 40 % of the total cost. It is given in five tranches linked to milestones. The balance of 60 percent is arranged by the developer.

The private developer will recover his investment from the government by receiving annuity payments over a period of 15 years

NHAI introduced HAM in January 2016 and has awarded more than 40% of roads under this model over the past five years.

Source: //www.thehindubusinessline.com/opinion/columns/slate/all-you-wanted-to-know-aboutham/article22060197.ece