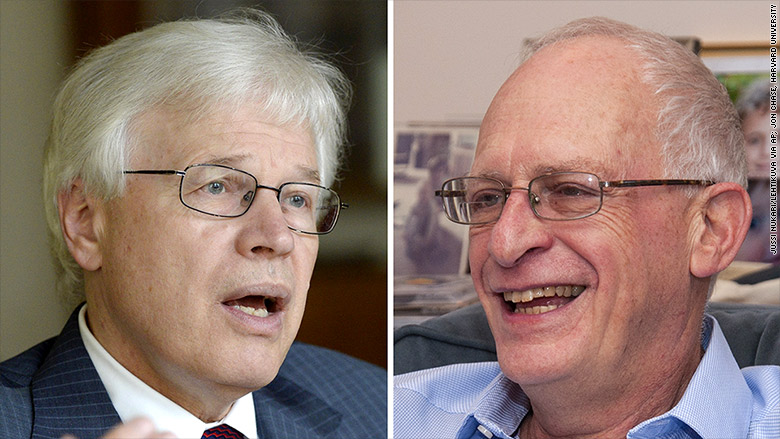

Oliver Hart and Bengt Holmstrom won the Nobel prize in Economics ( also known as Central Bank of Sweden Nobel Memorial Prize in Economic Sciences) in 2016 for their contributions to the ‘contract theory.’ Their work in contract theory helps us to:

- Understand real-life contracts.

- Understand potential pitfalls (difficulties) in designing the contracts.

- Design better contracts.

NOBEL PRIZE IN ECONOMICS

Unlike Nobel prizes in other areas, the economics award is a collaboration between the Central Bank of Sweden, known as the Sveriges Riksbank, and the Nobel Foundation. The Nobel prize in Economics was first awarded in the year 1968. Last year the award was given to Angus Deaton for his analysis of consumption, poverty, and welfare. (Read about it in this article: /why-angus-deaton-got-the-nobel-prize-in-economics/)

CONTRACT THEORY

Contracts are ubiquitous. We see them everywhere. Some examples of contracts are contracts between employer and employee (employment contract), shareholders and CEO (employment contract), banks and borrowers (credit contract) etc. The employment contract explicitly states rewards for good performance, conditions of dismissal etc.

The parties to the contracts often have conflicting interests. To illustrate: The CEO of a company wants to maximize their own earnings rather than that of the shareholders. It leads to short-termism where CEOs focus on short-term gains instead of long-term stability. The same is the case with employers and employees.

Therefore, contracts must be properly designed such that the interests of the parties are aligned with each other. Example: If the CEOs are given compensation based on market value of shares, interests of CEO and shareholders will be aligned. The CEO will become more interested in taking decisions which will increase the market value of shares in the long run.

A good contract should give each party (with conflicting interests) the incentive to work with each other.

The research on contract theory had ignored two important issues: informational problems and incomplete contracts. Oliver Hart and Bengt Holmström made important contributions by filling up the research gap.

Bengt HOLMSTROM’S CONTRIBUTION

We know that the shareholders are the owners of the company and the CEO of a company takes decisions only on behalf of the shareholders or owners. It is essentially what is called a principal-agent relationship. The agent is authorised to take decisions on behalf of the principal.

The problem that arises in this relationship is that the principal (shareholders) cannot directly monitor the agent (CEO) and hence there is an information asymmetry (informational problems). The CEO has more information about his performance than the shareholders. This information asymmetry leads to moral hazard. The agent/ CEO want to increase their own pay-off by focussing on short-term goals the expense of the shareholders. (We had already discussed it in the previous head. It is just restating what we already know)

Contract theory basically deals with how the principal (shareholders) should design an optimal contract to incentivise the CEOs to work in the interests of the shareholders. Though this problem was known for a long time, the level of analysis increased only in the late 1970s.

Holmstrom’s research paper states that principal should design an employment contract and link the agent’s compensation to outcomes that convey meaningful information about the efforts put in by him. This is the informativeness principle.

To illustrate: If the CEO is paid based only on the market price of the shares, it would penalize the CEO for external factors beyond his control that affect the market price. The effect of such external factors can be eliminated by linking the CEO’s salary to the company’s share price in comparison to the share price of the competitors (other companies) in the same industry. It will provide more meaningful information about the efforts put in by him by eliminating the external factors.

It was a theoretical work. In later research, Holmström applied these results to realistic situations.

He analysed a dynamic situation in which an employee’s current salary is not linked to his performance (as he had prescribed in the informativeness principle). He found out that inspite of that, young employees were motivated to work hard due to concern about career and future salary. In such cases, performance must be linked to higher future earnings (if not current earnings). This is known as the career-concern model.

Another realistic situation is in which the jobs are made up of multiple tasks (which is true for most cases). For example, a teacher has multiple tasks, improving test scores, developing student creativity etc.

In such cases, performance in one task may be easier to assess. Test scores are easier to measure than student creativity. So, compensation linked to test scores will encourage teachers to spend more time increasing test scores at the expense of other important tasks like creativity

In the same way, salary linked to the easily measured parameters, like profits, can also be counterproductive. Profits will be increased at the expense of other important things like brand reputation or product quality. Therefore, in jobs with multiple tasks, firms can opt to offer fixed salaries rather than salary based on performance. This is the Multi-tasking model.

Another situation is a partnership scheme that shares profits amongst team members. It creates a problem as individual members of a team can free-ride on the efforts of others. Each team member gets the same share of profit irrespective of the efforts put in by him.

Holmström shows that the free-rider problem can be resolved by introducing an outside owner who will provide compensation based on performance and keep the remaining profit with himself. It will boost individual incentives.

Oliver HARTS’S CONTRIBUTION

Hart deals with an important case of incomplete contracts. It is impossible to write a detailed contract which includes respective rights and duties of parties for every possible future situations. Contracts in real-world are generally incomplete as it does not take into account all future contingencies.

There is a lot of uncertainty and it could lead to disputes in the future. Mr Hart showed that firms can solve this problem by use of the bargaining power. The main idea is that a contract that cannot explicitly specify what the parties should do, specify who has the right to take decisions decide (bargaining power) in the case of future contingencies.

Asset (machinery etc.) owners have stronger bargaining power, which motivates them to invest. Therefore, the asset should be owned by the party whose investment is most important for the business This will give him the bargaining power and the incentive to invest in the business.

It also shows that highly synergistic assets – whose values are enhanced when used together – should be owned by a single party, rather than separately by multiple parties. Concentrating bargaining power in the hands of one party is more effective than diffusing bargaining power across multiple parties.

The theory has real-world relevance as well. Mr. Hart used it to explain precisely why public prisons are better than private prisons. The managers of both care about the profit, but the incentive to cut costs is greater in private prisons because the private owner gets all the profits directly in his pocket.

CONCLUSION

Through their contributions, Hart and Holmström have explored many of the applications of the contract theory in the real-world. The Academy said, ” “It generates precise hypotheses that can be confronted with empirical data and lays an intellectual foundation for the design of various policies and institutions, from bankruptcy legislation to political constitutions.”

Indian government can use the contract theory in policy-making. It can be used in the design of telecom auctions, Direct benefit transfer scheme etc.

Please leave your feedback about this article on the comment box below.

References:

Press Release: The Prize in Economic Sciences 2016

The prize in Economic Sciences 2016

Here’s why contract theory deserves a Nobel Prize

Why the 2016 economics Nobel for contract theory really matters