The National Statistical Office (NSO) released the GDP figures for the July-Sept quarter (Q2) for the current fiscal year 2019-20

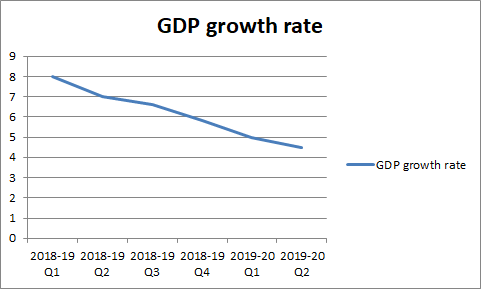

India’s GDP fell to 4.5 % in Q2 from 5 % in Q1

This is the fifth consecutive fall in quarterly GDP.

The GDP in the April-June quarter (Q1) of 2018-19 was 8 %. Since then GDP has declined.

The GDP is also at 6 years low. The last time the GDP had fallen below the psychologically important 5 % mark was in Jan-Mar 2012-2013 when the economy grew at 4.3 %

If we look at sectoral growth, we find that the slowdown has been across all sectors. There has been a contraction in manufacturing by 1 % as compared to 0.6 % growth in the previous quarter.

The growth of 4.5 % was mainly due to growth in the public administration segment which grew at 11.6 % supported by an increase in Government expenditure.

| Q2 (%) | Q1 (%) | |

| Agriculture | 2.1 | 2 |

| Mining | 0.1 | 2.7 |

| Manufacturing | -1 | 0.6 |

| Electricity and other public utilities | 3.6 | 8.6 |

| Construction | 3.3 | 5.7 |

| Trade, hotel, transport, communication | 4.8 | 7.1 |

| Financial services | 5.8 | 5.9 |

| Public administration | 11.6 | 8.5 |

If we look at the expenditure of various entities, we find that there has been a modest revival in consumption expenditure growth, but it is still low at 5 %. Private investment growth is stagnant at 1 %. Hence, Government expenditure at 15.6 % was solely responsible for pulling up the GDP.

| Q2 (%) | Q1 (%) | |

| Consumption | 5 | 3.1 |

| Private Investment | 1 | 4 |

| Government expenditure | 15.6 | 8.8 |

If we exclude Government expenditure, the GDP growth would have been much lower at 3.05 %.

[Read: GDP demystified]

Clearly, there has been a slowdown.

Let us discuss the reasons for the economic slowdown

1. Non-performing assets (NPA) in banks: The RBI had conducted an asset quality review of banks in the year 2015 to ensure that banks are classifying loans as NPA properly. This led to an increase in the assets classified as NPAs in the balance sheets of banks. Since then, the RBI and the Government have been taking steps to clean up the balance sheets of banks (like the enactment of Insolvency and Bankruptcy code), but it has led to a decline in the credit availability for corporates. Banks have become risk-averse in giving out loans. This has affected private investments.

[Read: The Non-performing Assets problem explained]

2. The liquidity crisis in Non-bank financial corporations (NBFCs): The small and medium sector enterprises (SMEs) were mainly dependent on NBFCs for loans. However, NBFCs are facing a liquidity crunch.

It is to be noted that the NBFCs cannot accept public deposits. They borrow from banks to meet their funding requirements. After the default of IL&FS, banks have become wary of lending money to NBFCs. (Recently Dewan Housing Finance Limited (DHFL) also defaulted.) The liquidity crisis has further limited credit availability to SMEs and the real-estate sector.

[Read: Everything you wanted to know about the IL&FS crisis]

3. Demonetisation: Demonetisation adversely impacted the informal economy which is largely dependent on cash. The informal sector in India accounts for 45 % of GDP and 80 % of employment. The job losses in the informal sector have led to a decline in consumption.

[Read: The impact of Demonetisation]

4. GST: Instead of simplifying, GST has increased complexities for traders due to multiple rates and delay in input tax credit refunds.

[Read: The Goods and Services Tax demystified]

5. Weak monetary policy transmission: The RBI has already cut rates five times this year. The current repo rate stands at 5.15%. But, banks haven’t cut lending rates for the borrowers. Hence, interest rates still remain high.

[Read: Repo, CRR, SLR, Bank rate, Reverse Repo explained]

The Government has already undertaken some reforms to revive the economy like cut in corporate tax rate from 30 % to 22 %, merger of public sector banks, setting up of the real-estate fund etc. It also launched the biggest privatisation drive in a decade.

[Read: Government approves strategic disinvestment of 5 PSUs-explained]

The other steps that could be taken to tackle the economic slowdown are-

1. Monetary easing by RBI: There is a round of RBI monetary policy review scheduled on 5th December. The RBI is expected to cut rates further to increase the money supply in the economy. Besides cutting the repo rate, the RBI will also have to push the banks to pass on the interest rates cuts to the customers. The growth in credit is essential for reviving private investment.

2. Government expenditure: Even if the Government has limited fiscal space, it will have to spend more money. The Government should focus on improving rural income. Fall in rural wages is one of the major reasons for decreasing demand in the economy. The Government should increase its spending on the construction sector as well. The construction sector is a major source of non-farm income.

3. Factor market reforms: The Government is working towards consolidating all labour laws into four codes. But, we need more reforms in the labour market. Further, we need land reforms to ensure that corporates are able to acquire land easily and also landowners get adequate compensation for the same.

[Read: Why are labour law reforms required?]

4. Direct tax cuts: This will put more money in the hands of the middle class and salaried individuals and will revive consumption demand.

Finally, we discuss if the worse is over for the economy? Well, we have mixed signals. The GDP data is until September. Data released by the industry department showed that the eight infrastructure sectors represented by the core sector data contracted by 5.8 % in October. It had shrunk by 5.1% in September. So the economic slowdown might not have bottomed out for this quarter.

But, the GST collections for the month of November increased by 6% and crossed the 1 lakh crores mark reversing two months of decline. And, as mentioned earlier, the consumption expenditure growth showed a modest revival in Q2.

That’s all. If you find the article useful, do leave a comment. Also, share it with friends 🙂

You may also like to read this article- Why is Sensex Rising while the Economy is in Slowdown?

References for data: