The Financial Resolution and Deposit Insurance (FRDI) Bill is likely to be debated in the winter session of Parliament which begins on December 15, 2017. Currently, the bill is pending before a Standing Committee of Parliament.

This article explains the FRDI bill which has created a lot of unnecessary controversies.

Background of the FRDI Bill

India recently enacted the Insolvency and Bankruptcy code 2016. It was done to consolidate all the existing laws related to insolvency in India and to simplify the process of insolvency resolution. The law addresses the issue of insolvency in companies and partnership firms

(Read: The ultimate guide to understanding Insolvency and Bankruptcy code 2016.)

There is a need for a similar legal framework in the financial sector as well. There is no law at present in India to tackle insolvency in banks in an orderly and systematic way.

FRDI Bill seeks to provide a comprehensive resolution framework to deal with insolvency issues in the financial sector.

Financial sector entities include banks, Non-bank financial corporations (NBFCs), pension fund, mutual fund, insurance companies, stock exchanges, clearance houses etc.

The financial sector needs a specialised law because the modern financial system is interconnected to each other. A failure in one bank could have a contagion effect on other banks and the entire economic system could collapse like a house of cards.

Hence, the FRDI bill was introduced to enable orderly resolution of banks in case of failure and prevent a disruption to the economy.

(Read: The Financial Crisis 2008 Explained)

Existing framework:

There is no specific law dealing with the insolvency of banks in India.

The RBI and the other regulators have used tools like mergers and amalgamations in the past. But, these were ad-hoc solutions. There is no single law and agency to resolve the insolvency in a systematic way.

But, the Deposit insurance & credit guarantee corporation (DICGC) Act, 1961 guarantees that deposits up to Rs.100000 would be insured, if a bank becomes insolvent/ bankrupt. The amount is insured by Deposit Insurance & credit guarantee corporation (DICGC). DIGCC is a subsidiary of RBI

There is no clarity on what will happen to the deposits above Rs.100000.

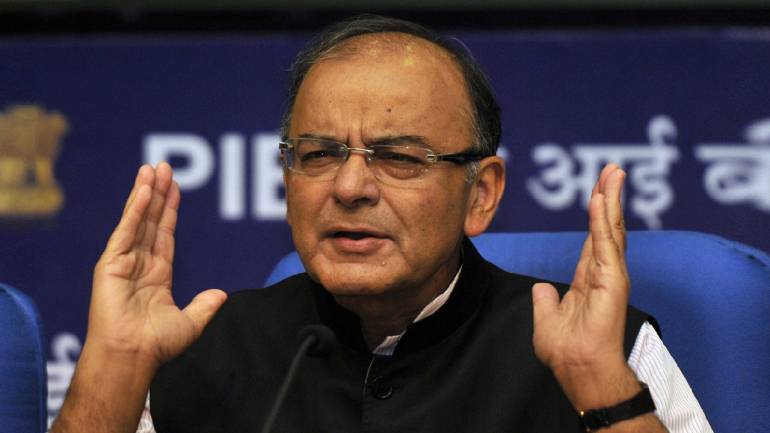

We have never faced any issues as the Government/ RBI has never allowed any scheduled commercial bank to fail. The Finance Minister, Arun Jaitley, has reiterated that this implicit guarantee for public sector banks will remain unaffected with the introduction of the FRDI Bill.

Co-operative banks have failed. The depositors of cooperative banks, which have been in losses, have not been able to get their money back after years because their deposits have been frozen. Once the FRDI is in place, the wait will be much shorter as there will be a time-bound resolution.

FRDI Bill:

The bill provides for the setting up of an independent new regulator, the Resolution Corporation (RC).

The RC will have representatives from all financial sector regulators namely the Reserve Bank of India (RBI), the Securities and Exchange Board of India (SEBI), the Insurance Regulatory and Development Authority of India (IRDA) and the Pension Fund Regulatory and Development Authority (PFRDA). It will also have members from the ministry of finance as well as 2 independent members, 3 full-time members and a chairman.

The existing DICGC Act will be repealed and DICGC will be closed.

The Resolution Corporation or RC will insure deposits. The insured amount will be determined in consultation with the RBI and is unlikely to be below the existing Rs.100000.

[It is also to be noted that the Rs. 1 lakh insurance limit covers 93 % of the depositors (in number) in the country. In other words, only 7 % keep deposits above Rs. 1 lakh in a particular bank. So, the masses have been covered.]

The important task of the RC is to closely monitor financial firms and classify financial firms on the basis of their risk of failure — low, moderate, material, imminent, or critical. The factors to be considered while classifying are capital adequacy ratio, liquidity, asset, liabilities, leverage ratio etc.

The monitoring will help the banks to anticipate failure and take necessary corrective actions in advance.

If the bank is classified as critical, the RC will step-in to resolve and take over the management of the bank.

The RC has various tools at its disposal for resolution: mergers, acquisitions, portfolio transfers, bail-in, setting up of bridge service providers etc.

The last resort is liquidation. In case of liquidation, the RC will oversee its orderly demise.

[Bridge-service provider is a temporary institution established to take over the operations of a financial institution, for a maximum period of 1 year.]

Bail-in clause:

As mentioned, the bill includes a ‘bail-in’ clause. It is one of the tools at the RC’s disposal to resolve a failed bank. It means that the cost of bank failure should be borne by the stakeholders of the bank.

We know what is ‘bail-out’. In ‘bail-out’, the Government uses the taxpayers’ funds to support the bank. In the aftermath of the financial crisis of 2008, many banks had to be bailed out in countries like the US, Europe etc.

In ‘bail-in’, stakeholders funds (shareholders, depositors etc.) is used to provide support to the bank.

It implies that the deposits over the insured amount (Rs.100000) will be used to support the bank. These deposits can be converted into equity shares.

As per the proposed bill, the bail-in can be invoked only if you have given your consent to the bank when you signed the deposit forms.

In November 2011, the G2o leaders had endorsed some of the key attributes of such type of resolution.

Conclusion

The Bill has generated unnecessary controversies

The finance ministry has clarified in a statement “The provisions contained in the FRDI Bill, as introduced in the Parliament, do not modify present protections to the depositors adversely at all. They provide additional protections to the depositors in a more transparent manner. The FRDI Bill will strengthen the system by adding a comprehensive resolution regime that will help ensure that, in the rare event of failure of a financial service provider, there is a system of quick, orderly and efficient resolution in favour of depositors.”

To sum up, if we look beyond the political rhetoric, it is clear that the risk to the depositors will be no more than what it is today

Enjoyed this post? Don’t forget to share:)

You may subscribe to my blog by email: click here

References

FRDIbill aimed at protecting depositors’ interests