There has been a pronounced change in the approach of Government in dealing with the unemployment crisis. The current approach is more based on creating small entrepreneurship or giving the people more opportunities to start small-scale enterprises of their own.

Hence, Pradhan Mantri Mudra Yojana is being viewed as an essential tool to fill the credit needs of Non – Corporate Small Business Sector (unorganized sector) by adding them to the formal banking system. This article explains all relevant features related to PMMY.

What is MUDRA?

MUDRA, which stands for Micro-Units Development & Refinance Agency Ltd, is a financial institution being set up by Government of India for development and refinancing micro units enterprises. Announced by the Hon’ble Finance Minister Shri Arun Jaitley while presenting the Union Budget for FY 2016, it is responsible for funding to the non-corporate small business sector through various Last Mile Financial Institutions like Banks, Non-Bank Financial Corporation (NBFCs) and Micro Finance Institutions (MFIs)engaged in lending to small-scale businesses.

The Government of India in January 2016 converted MUDRA Ltd, a Non-Bank Financial Corporation into MUDRA Bank. MUDRA Bank thus created is a wholly-owned subsidiary of Small Industries Development Bank of India (SIDBI), which will be known as MUDRA (SIDBI) Bank.

Why has MUDRA been set up?

The biggest bottleneck to the growth of entrepreneurship in the non-corporate small business sector is a lack of financial support to this sector. The support from the Banks to this sector is meagre, with less than 15% of bank credit going to Micro, Small and Medium Enterprises (MSMEs).

According to the Economic census -2014, formal banking system addresses only 4 percent of the credit needs of 5.8 crore small and micro enterprises. Besides, a vast part of the non-corporate sector operates as unregistered enterprises. They do not maintain proper Books of Accounts and are not formally covered under taxation areas.

In the above backdrop, the Micro Units Development & Refinance Agency Ltd (MUDRA) was set up by the Government of India (GOI). MUDRA would be responsible for developing and refinancing all Micro-enterprises sector by supporting the financial institutions which are in the business of lending to micro / small business entities engaged in manufacturing, trading and service activities.

What is MUDRA Loan?

Under the aegis of Pradhan Mantri Mudra Yojana, MUDRA Bank has created its initial products/schemes. The interventions have been named as ‘Shishu’, ‘Kishor’ and ‘Tarun’. The financial limits of these schemes are:-

- Shishu: covering loans up to Rs 50,000.

- Kishor: covering loans above Rs 50,000 to Rs 5 lakh.

- Tarun: covering loans above Rs 5 lakh to 10 lakh.

Who are entitled to get a loan from MUDRA Bank?

MUDRA loan is extended for a variety of purposes which provide income generation and employment creation. The loans are extended mainly for :

(i) Business loan for Vendors, Traders, Shopkeepers and other Service Sector activities.

(ii) Working capital loan through MUDRA Cards ( MUDRA Card is a RuPay debit card with the following features – Cash credit / overdraft facility is available, MUDRA Card can be operated across the country for withdrawal of cash from any ATM / micro ATM and also make payment through any ‘Point of Sale’ machines).

(iii) Equipment Finance for Micro Units.

(iv) Transport Vehicle loans.

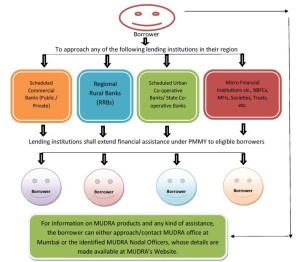

Whom to approach for assistance under PMMY?

All Public Sector Banks, Regional Rural Banks (RRBs), Cooperative Banks, Private Sector Banks, Foreign Banks, Micro Finance Institutions and Non-Banking Finance Companies.

Conclusion

Since the launch of the Pradhan Mantri Mudra Yojana (PMMY) in April 2015, over 30 million borrowers have been given around Rs 1.23 lakh crore worth of loans under the scheme. This scheme is largely based on the idea of ’empowering’ people to overcome their deprivations and disabilities.

So, one really hopes that the scheme and programme launched by our government are able to deliver their intended outcomes. But at the same time, it is also important that the loans are issued prudently and monitored closely so that there will not be any rise in Non-performing Assets (NPAs)

You can check out these articles on our blog:

Gold Monetisation and Sovereign Gold Bond Scheme Explained

Insolvency and Bankruptcy Code Explained

Financial Inclusion and Pradhan Mantri Jan Dhan Yojana

References-